Siana Gold Project

| At A Glance | |

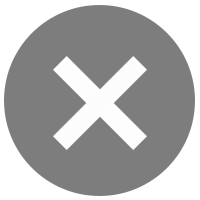

| Location | Alegria, Mainit, Tubod and Bacuag Municipalities, Surigao Del Norte Province |

| Business activities | Development of gold and silver resources in a proposed open pit and underground mine |

| Deposit Type | Gold-Silver Replacement Type Deposit |

| Resource | Combined Indicated and Inferred Underground Resource at 3.9M tonnes at 5.7 g/t Au and 7.7 g/t Ag |

| Logistics | Surigao and Butuan are chartered cities that can be reached via daily flights from Manila |

On July 2021, TVIRD signed an investment agreement to acquire 100% of the outstanding equity in Greenstone Resources Corporation (“GRC”), the Philippine affiliate of an Australian-based gold company, Red 5 Limited (“Red 5”) (ASX: RED). GRC is the owner and operator of the Siana Gold Project (“Siana”) and Mapawa Project (“Mapawa”), both situated in the southern Philippines, Mindanao Island.

As confirmed by Red 5 to TVIRD, more than US$200 million was spent by GRC to develop the Siana Project, with known assets listed below:

- Modern 1.1mtpa Outotec mill, gravity and Carbon-in-Leach (“CIL”) mill facility commissioned in 2012 at a capital cost of US$54 million that includes a single stage SAG mill and six (6) CIL tanks;

- Grid power with back-up 8MW diesel fired power station;

- Administration building, warehouse, mess hall, camp facilities and accommodation, engineering building and maintenance facilities.

Also included in the assets of GRC is the Mapawa Project which is located north of Siana mine and has the potential to be developed as a satellite source of ore feed for the Siana processing plant. This mining facility built by GRC has the only modern gold plant in the region which has the capacity to become a processing center for other nearby prospects.

Siana was known to produce roughly one million ounces of gold prior to its acquisition by GRC in 2003. An exploration program was initiated by GRC in 2004 and a feasibility study completed in 2009. This was immediately followed by the construction phase in 2010. The first gold pour at the Siana Project under GRC occurred in February 2012. Approximately 149K ounces of gold and 200K ounces of silver have been produced from GRC’s Siana open pit mine operation since acquired by GRC in 2003.

The Siana mining and processing activities were temporarily put on hold in April 2017 due to uncertainties in mining policy in the Philippines and challenges in obtaining environmental permits. During the period of suspension, site activities have been focused on dewatering the open pit, infrastructure maintenance and monitoring geotechnical issues.

GRC then planned to re-commence mining operations through open-pit mining followed by a transition to underground mining. GRC has reportedly completed 445 meters of underground mine development, construction of three portals and the establishment of several critical infrastructures for the underground mining operations.

While the Siana Project is currently on voluntary care and maintenance, it held all the necessary government permits to restart operations, including an Environmental Compliance Certificate and an approved Declaration of Mining Project Feasibility. Updated status is stated under Siana Mining Development and Production Plan.

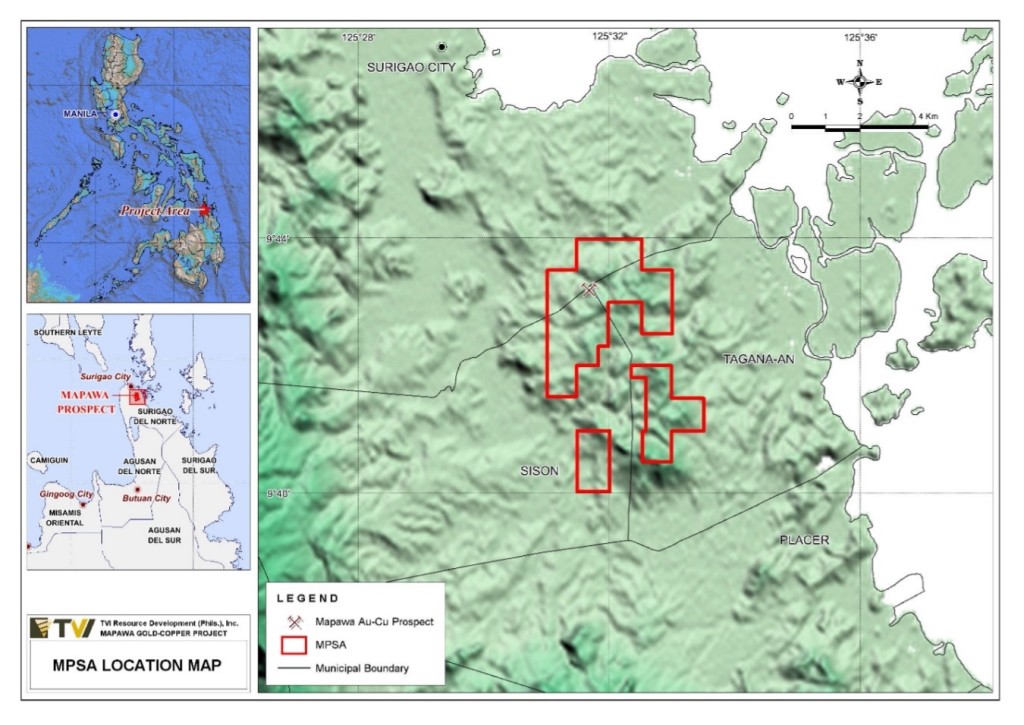

Both Siana and Mapawa are located at the northern part of Mindanao Island, approximately 30 aerial kilometers south of Surigao City and 84 kilometers north of Butuan City. Siana and Mapawa encompass the municipalities of Alegria, Mainit, Tubod and a small portion of Bacuag, Surigao Del Norte. The primary impact barangays (“Brgy”) surrounding the Siana Gold Project include: Brgy. Siana and Dayano, Municipality of Mainit; and Brgy. Cawilan, Municipality of Tubod, Surigao del Norte.

Surigao and Butuan are chartered cities that can be reached via daily flights from Manila, taking 1 hour and 10 minutes to Surigao and 1 hour 25 minutes to Butuan. Surigao, which has two (2) port facilities, can also be reached by sea from Manila.

The Siana Project is situated within the boundaries of MPSA No. 184-2002-XIII which is composed of two non-contiguous northern and southern blocks, with total respective areas of 2,023.74 hectares and 1,265.03 hectares, respectively. The MPSA was granted on December 11, 2002 and registered with the Philippine Mines and Geoscience Bureau (“MGB”) on December 27, 2002 for a term of 25 years. The northern block of the MPSA includes the Siana Project while the southern block covers the Alegria claim, which is considered a potential exploration target.

Meanwhile, the Mapawa prospect, which is located 20 kilometers north of Siana, is under MPSA No. 280-2009-XIII and covers 1,482 hectares.

The Surigao Peninsula at the northeastern tip of Mindanao is characterized physiographically by a narrow north-northwest trending ridge, the Malimono ridge, and the wider and more geologically complex Diwata mountain range to the east. Intervening between these two topographic highs is a structurally-controlled valley, in fact a graben, from the Surigao lowlands in the north, to Lake Mainit and the Tubay Valley southwards. This topographically depressed corridor is interrupted by a young volcanic center, the Maniayao highlands, sitting north of Lake Mainit.

The oldest rock unit identified in Siana Project is the Bacuag formation, the limestone and marly sedimentary members of which mainly host the gold mineralization in the Siana mine. Unconformable on top of the Bacuag is the Middle-Late Miocene Mabuhay Clastics, observed southwest of the Siana pit, and the Late Miocene-Pliocene Timamana limestone, occurring as tower karsts mostly east of the Siana mine. The Bacuag and, probably, the Mabuhay clastics, are intruded by porphyritic andesite that is related to the Pliocene Maniayao volcanism. The andesite porphyry in the northern tip of the Siana pit is observed as post mineral intrusion to the Bacuag.

North-northwest trending faults are the major structures, several splays of which transect the parcel, including horse-tail splits in the north. Antithetic northeasterly faults are also observed to intersect the northwesterlies, as observed in the Siana pit.

Such geological setting continues in the southern portion of the Siana MPSA, including the Alegria claim, where regional north-northwest to south-southeast structures transecting Siana extend southwards. The dominant rock types in the Alegria parcel, however, are volcaniclastic sequences and the intruding andesite porphyry.

Siana is located along the Surigao Valley Fault, a major structure that is part of the Philippine Fault Zone. The area is known for various mineralization such as epithermal gold and porphyry-type copper-gold mineral deposits.

Mineralization in the Siana orebody occurs in both the limestone and basalt members of the Bacuag Formation, although earlier works describe mineralization to be confined only in the carbonates (UNDP, 1988). Ore in the limestone occurs as either high grade “massive sulfide” bodies consisting of pyrite, sphalerite, galena, chalcopyrite and quartz in cavities, or as disseminated gold in the clay or gouge portions and limestone. The massive sulfide bodies are as much as 7 meters long, with gold grades reaching 30 g/t Au.

Basalt-hosted mineralization to the east of the Siana pit occurs in soft, bleached, pyritic alteration zones, often 10 meters or more in width, over a lateral distance of approximately 140 meters. Minor mineralization also occurs within the volcaniclastics of the Mabuhay Formation. Mineralization progressively narrows to the south in both the carbonate and basalt hosts but is known to persist to approximately 400 meters below surface.

Prior to the acquisition of Siana by GRC in 2003, past mine production yielded 4.9M tonnes at 6.4 g/t Au, producing approximately 1.1M ounces. The Siana orebody was mined underground from 1935 to 1960 and by open pit from 1980 to 1991. Following its first gold pour in February 2012 after completing construction, GRC produced a further approximate 149K ounces of gold and 200K ounces of silver through open-pit mining between February 2012 and April 2013, and February 2015 and April 2017.

The current main Siana orebody continues to be open at depth and laterally for further exploration.

Reports indicate that the gold and sulfide mineralization present in the southern portion of the Siana tenement are hosted in andesite porphyry and intruded sediments where gold mineralization is more widespread. Exploration soil geochemistry indicates that a high level or near-surface epithermal system is possibly preserved in the area. A deeper copper-dominated type of mineralization reportedly appears to characterize the Alegria claim. Lenses of massive sulfides and hematite have been encountered in the immediate vicinity, prompting earlier workers to consider a skarn type origin for such mineralization.

Similarly, the Mapawa prospect hosts a known gold and porphyry system with a number of significant gold occurrences throughout the project area.

Red 5 has previously reported that both Siana and Mapawa tenements are considered to have significant mineralization potential on which advanced exploration programs can be developed in the future.

Early resource drilling on the Siana Project was conducted by Suricon Consolidated Mining Company (“Suricon”) from 1975 to 1981 through which 30 holes were drilled totaling 3,514 meters. A second campaign of drilling took place during the open-pit operations from 1983 to 1989, consisting of 47 holes with a total meterage of 6,893 meters. These holes were drilled from the open pit benches as the pit was progressively deepened.

GRC commenced its first drilling campaign in 2003. A limited program of Reverse Circulation (“RC”) and diamond drilling was undertaken with encouraging results. This was followed by a major diamond drilling program targeted along strike of, and below, the old open-pit. Drilling included specialized geotechnical and metallurgical holes.

The next phase of drilling was initiated in 2011, with holes drilled to the north, south and east of the Siana pit to follow up mineralization extensions along strike and at depth.

The database used for the Siana Mineral Resource Model includes 109 holes with 47,300 meters plus the 79 historic Suricon holes drilled between 1980 to 1990 for approximately 10,600 meters and 10,417 Grade Control channel samples conducted by GRC before the cessation of operations in April 2012.

On the other hand, the Mapawa Mineral Resource Estimate was calculated based on a total of 78 diamond core drillholes with total meterage of 13,798 meters, comprising 5,628 meters of historical drilling completed by Suricon and 8,170 meters of additional drilling completed by GRC.

Red 5 has previously published both open-pit and underground mineral resource estimates for the Siana Project in accordance with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (“JORC 2021”). A separate mineral resource estimate which is JORC 2012-compliant was also reported for the Mapawa Prospect.

As presented in the Red 5 Annual Report dated June 30, 2020, the remaining resource in the Siana open pit model is estimated to be 650K tonnes of Indicated Mineral Resource with average grades of 3.7 g/t Au and 7.9 g/t Ag. The estimated Inferred Mineral Resource stands at 30K tonnes of 2.8 g/t Au and 1.2 g/t Ag. A cut-off grade of 0.7 g/t Au was considered in reporting the open-pit mineral resource.

In 2016, Mining One Pty Ltd completed an updated Mineral Resource Report which covers the potential underground mineral deposit below the Final Stage 4 Open-Pit Design and has been reflected in the June 2020 Annual Report of Red 5 following what they have stated to be their annual review. Using a cut-off grade of 2.4 g/t gold, the Indicated Mineral Resource is at 3.4M tonnes with average grades of 5.2 g/t Au and 7.2 g/t Ag. Meanwhile, the estimated Inferred Mineral Resource is at 500K tonnes at 9.3 g/t Au and 11.2 g/t Ag.

Table 1. Siana Open-Pit Mineral Resource as reported in Red 5 Annual Report in June 2020

| Classification | Cut-off Gold (g/t) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Cont. Gold (koz) | Cont.Silver (koz) |

| Indicated | 0.7 | 650 | 3.7 | 7.9 | 77 | 164 |

| Inferred | 0.7 | 30 | 2.8 | 1.2 | 3 | 1 |

| Total | 0.7 | 680 | 3.7 | 7.6 | 74 | 156 |

Table 2. Siana Underground Mineral Resource as reported in Red 5 Annual Report in June 2020

| Classification | Cut-off Gold (g/t) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Cont. Gold (koz) | Cont.Silver (koz) |

| Indicated | 2.4 | 3,400 | 5.2 | 7.2 | 566 | 779 |

| Inferred | 2.4 | 500 | 9.3 | 11.2 | 153 | 186 |

| Total | 2.4 | 3,900 | 5.7 | 7.7 | 719 | 965 |

Mining One Pty Ltd, with offices in Australia, China, Indonesia and Canada, has extensive experience in the Philippines, Papua New Guinea, Indonesia, Africa, South America and China and with underground and open pit mines across a broad range of commodities. They are involved in planning, supervision, project management, studies, geology, contracts, financing and corporate assistance and advice and their clients have included, among others, BHP, Rio Tinto, Glencore. Alcoa, Anglo American, Anglo Gold Ashanti, Barrick.

A Mineral Resource estimate for the Mapawa prospect was completed by Optiro Pty. Ltd. In 2016. At a cut-off grade of 0.7 g/t Au, the estimated Indicated Resource is at 3.27M tonnes with average grades of 1.0 g/t Au and 3.5 g/t Ag. Using the same cut-off, the Inferred Resource is at 5.6M tonnes at 1.0 g/t Au and 2.5 g/t Ag.

Table 3. Mapawa Mineral Resource as reported in Red 5 Annual Report in June 2020

| Classification | Cut-off Gold (g/t) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Cont. Gold (koz) | Cont.Silver (koz) |

| Indicated | 0.7 | 3,270 | 1.0 | 3.5 | 103 | 371 |

| Inferred | 0.7 | 5,560 | 1.0 | 2.5 | 185 | 438 |

| Total | 0.7 | 8,830 | 1.0 | 2.9 | 288 | 809 |

Optiro Pty. Ltd. Is an advisory services firm with extensive geological, mining engineering, metallurgical and financial expertise that provides strategic, independent advice to mining and exploration companies, their advisors and investors. Their consultants are recognized competent persons under JORC and other international standards and have published numerous reports supporting listings on the ASX, TSX, LSE, NYSE and various other stock exchanges around the world.

GRC has mined Siana deposit by open-pit method prior to being placed on care and maintenance in April 2017. Siana has produced 149,203 ounces of gold and 199,669 ounces of silver during its open-pit operation.

As stated in the Red 5 Annual Report in June 2020, the remaining stockpile from the Siana open-pit mine approximates 290K tonnes with average grades of 1.1 g/t Au and 6.6 g/t Ag.

GRC completed a JORC 2012-compliant Underground Ore Reserve Estimate in 2016 using a cut-off grade of 2.4 g/t Au. The estimated underground Probable Ore Reserve is at 3.0M tonnes at 4.1 g/t Au and 7.2 g/t Ag.

Table 4. Siana Undeground Ore Reserve Estmate as reported in Red 5 Annual Report in June 2020

| Classification | Cut-off Gold (g/t) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Cont. Gold (koz) | Cont.Silver (koz) |

| Probable | 2.4 | 3,010 | 4.1 | 6.7 | 396 | 644 |

| Total | 2.4 | 3,010 | 4.1 | 6.7 | 396 | 644 |

To be updated after Mining One resource-reserve update.

TVIRD understands that GRC planned to re-commence mining operations with a period of approximately 2 years of open pit mining followed by a transition to underground mining after completion of the open-pit and after underground mine development had commenced. As stated earlier, underground mine development has commenced with 445 meters of development completed, three portals developed and the establishment of several critical surface infrastructures for the mining operations, and TVIRD understands that GRC had planned to mine underground for an approximate 8 years once commenced.

TVIRD is presently assessing the GRC mine development and production plan for Siana to develop its own plan before operations are re-started.

To-date, GRC made significant progress in resuming the Mine and Mill Operations at the Siana Mine. Key milestones were achieved in terms of Mines, Process Plant and TSF construction.

The Process Plant was successfully commissioned last December 2022 ahead of its planned schedule. The plant milled 48,459 tonnes of ore with an average grade of 0.87 g/t Au and 3.44 g/t Ag. As of February 2023, 62.3 kilograms of doré containing 896 oz of Au have been smelted and a total of 83.3 kilograms of doré containing 1,229 oz of Au have been shipped.

At the Mines, 8.01Mt of material have been moved and is currently within schedule to reach the main ore body by the 1st half of 2024. Slope stability measures are likewise in place to support mine operations.

Also as of February 2023, an additional 5,615 tonnes of ore averaging at 1.40 g/t Au were produced and delivered to the ROM pad where a build-up of medium and high-grade ore stockpiles is ready for blending options with low grade stockpiles.

The construction of TSF-6 has made significant headway and is expected to be fully complete by April 2023 while hydrotesting of the pipelines from the Process Plant to TSF-6 have been successfully completed. In March 2023, TSF-6 was commissioned and is now currently containing the tailings discharge from the Process Plant..