Mabilo Project

| At A Glance | |

| Ownership: | Mt. Labo Exploration and Development Corporation (100%), of which TVI Resource Development Phils., Inc. holds a 60% interest through its 100% ownership of SageCapital Partners, Inc. |

| Location | Camarines Norte Province, Eastern Luzon, Philippines |

| Business activities | Brownfield project that includes a mineralized deposit classified as a copper-gold-iron skarn deposit offering potential for multi-metal products, namely copper, gold and silver, with by-products magnetite (Fe3O4) and pyrite (FeS2). |

| Deposit Type | Copper-Gold-Iron skarn deposit |

| Resource | Combined Indicated and Inferred 12.8M tonnes at 1.8% Cu, 1.9 g/t Au, 9.6 g/t Ag and 40.5% Fe |

| Probable Reserve | 7.8Mt at 2.0% Cu, 2.0g/t Au, 8.8g/t Ag and 45.5% Fe |

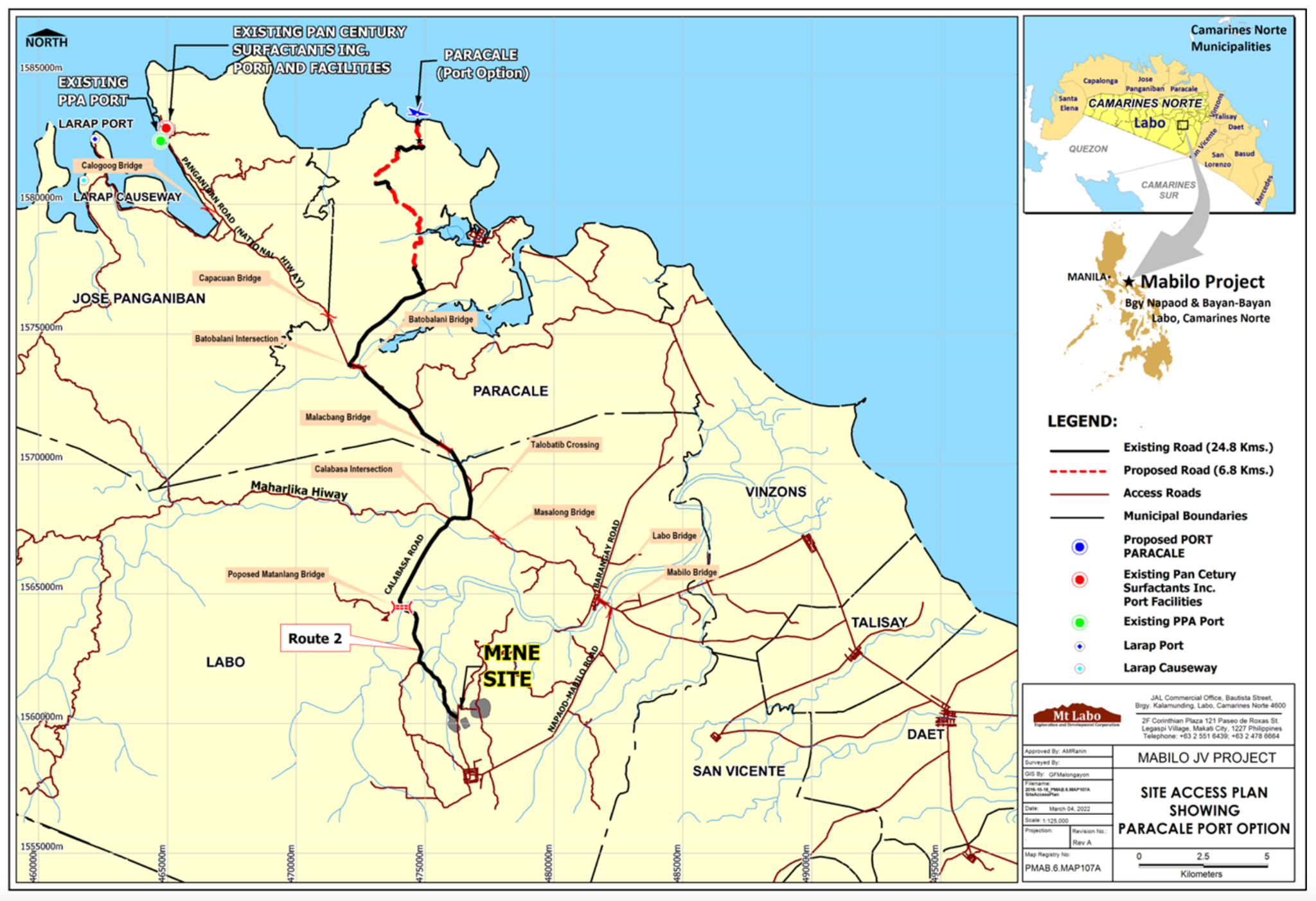

| Logistics | Accessed from the nearby town of Labo, using a 15 km all-weather road. |

TVIRD has acquired in Q1 2022 all of the outstanding capital stock of SageCapital Partners, Inc. (“SageCapital”), pursuant to a Sale and Purchase Agreement (the “SageCapital Agreement”) between TVIRD and a third-party resident in the Philippines (“Vendor”). SageCapital is a holding company incorporated under the laws of the Philippines, which, in turn, owns 60% of the outstanding capital stock of Mt. Labo Exploration and Development Corporation (“MLEDC”), a Philippines mining and minerals exploration development company whose projects are based in Camarines Norte, Philippines, and which is the owner and operator of the Mabilo Project (“Mabilo”) located in the Camarines Norte Province, Eastern Luzon, Philippines.

MLEDC prepared a feasibility study on Mabilo in May of 2016 (“Feasibility Study”), which Feasibility Study was supported by a technical report entitled “Mabilo Project National Instrument 43-101 Technical Report” prepared by Lycopodium Minerals Pty Ltd. dated and filed on May 2, 2016, with a mineral reserve and mineral resource effective date of November 2015. RTG Mining Inc. (“RTG”), which holds a 40% interest in MLEDC through SRM Gold, has filed the Technical Report under RTG’s SEDAR profile (the “Mabilo Technical Report”). The Mabilo Technical Report reflects a historical Probable Mineral Reserves estimate of 7.8Mt at 2.0% Cu, 2.0g/t Au, 8.8g/t Ag and 45.5% Fe. Metal price assumptions applied in the Mabilo Technical Report were US$5,200/tonne for Cu, US$1,125/oz for Au, US$15/oz for Ag and US$65/tonne for magnetite. TVI considers this report no longer current and cautions that it should not be relied upon.

Mabilo is covered by an approved Declaration of Mining Project Feasibility (“DMPF”) and Environmental Compliance Certificate (“ECC”) for initial direct shipping ore (“DSO”) operations issued by the Mines and Geosciences Bureau (“MGB”) and the Environmental Management Bureau, respectively, of the Department of Environment and Natural Resources (“DENR”) of the Republic of the Philippines.

With an open-pit mining method contemplated at Mabilo, the lifting of the open-pit mining ban in the Philippines as announced by the DENR of the Republic of the Philippines on December 23, 2021, is a significant development.

The Mabilo Project is located in Camarines Norte Province, Eastern Luzon, Philippines which is one of the major traditional gold mining centers in the Philippines. The area is easily accessed from the nearby town of Labo, using a 15 km all-weather road.

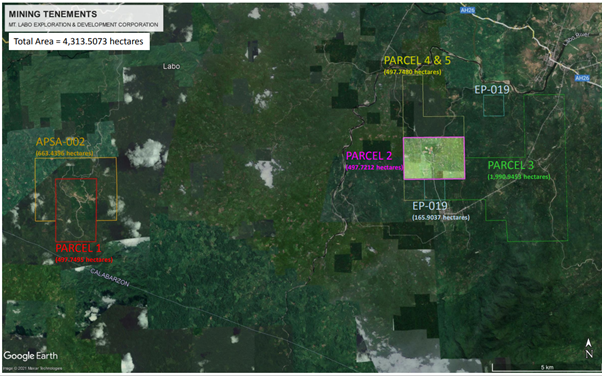

The project is covered by Philippines Mineral Production Sharing Agreement (“MPSA”) MLC-MRD V-459 Amended (Renewal) and two (2) additional blocks with an existing Exploration Permit (EP-019-202-V), and EXPA 240 application (APSA002) covering 4,313.5073 hectares and 165.9 hectares.

With a near-surface deposit, Mabilo has potential for DSO and it is contemplated that mining will use an open-pit mining method. The Mabilo mineralized deposit is classified as a copper-gold-iron skarn deposit that offers potential for multi-metal products, namely copper, gold and silver, with by-products magnetite (Fe3O4) and pyrite (FeS2).

MLEDC undertook its first drilling program in 2012 designed to target the seven magnetic anomalies identified by ground magnetics survey. The second drilling program followed in 2013 to 2015 during which time 112 drillholes were completed with a total meterage of 19,542 meters. The MGB validated in March 2018 the June 2015 Final Exploration Report submitted with the application for a DMPF and the corresponding ECC and DMPF for initial DSO operations were approved in 2020.

The Mineral Resource estimate prepared by independent resource consultancy, CSA Global Pty Ltd (“CSA Global”) and announced by RTG on November 6, 2015, is based on data obtained from 99 diamond drillholes (18,201 meters) completed as of the end of September 2015 and a 0.3 g/t Au or 0.3% Cu grade cut-off. Holes were drilled on a nominal 40 meter by 40 meter drill pattern along strike, with infill to a nominal 20 meter by 20 meter in parts. The Mineral Resource estimate is filed under RTG’s SEDAR profile.

On November 5, 2015, RTG announced that a Mineral Resource estimate had been prepared by independent resource consultancy, CSA Global, which was later incorporated into the Feasibility Study. The Mineral Resource estimate is filed under RTG’s SEDAR profile.

The following Mineral Resource estimate is based on data obtained from 99 diamond drillholes (18,201 meters) completed as of the end of September 2015 and a 0.3 g/t Au or 0.3% Cu grade cut-off. Holes were drilled on a nominal 40 meter by 40 meter drill pattern along strike, with infill to a nominal 20 meter by 20 meter in parts.

Table 1. Mabilo Mineral Resource estimate as announced by RTG on November 5, 2015

| Classification | Million Tonnes |

Cu % | Au g/t | Ag g/t | Fe % | Cu Metal (Kt) | Au Oz (‘000s) | Fe Metal (Kt) |

| Indicated | 8.9 | 1.9 | 2.0 | 9.8 | 45.6 | 169.3 | 577.6 | 4,034.5 |

| Inferred | 3.9 | 1.5 | 1.5 | 9.1 | 29.0 | 58.0 | 184.9 | 1,134.1 |

| Total | 12.8 | 1.8 | 1.9 | 9.6 | 40.5 | 227.3 | 762.5 | 5,168.6 |

On May 2, 2016, RTG filed under RTG’s SEDAR profile the Mabilo Technical Report prepared by Lycopodium Minerals Pty Ltd. that is based on the results of a Feasibility Study completed on the Mabilo Project and reported:

Table 2. Mabilo Probable Mineral Reserve as filed by RTG on May 2, 2016

| PROBABLE | MINERAL | RESERVE | ESTIMATE | |||||

| Ore | Waste | |||||||

| Class | Type | Mt | Fe% | Au g/t | Cu % | Ag g/t | Mt | Strip Ratio |

| Gold cap | 0.351 | 40.1 | 3.11 | 0.38 | 3.26 | |||

| Probable | Supergene | 0.104 | 36.5 | 2.20 | 20.70 | 11.90 | 77.13 | 10.0 |

| Oxide scarn | 0.182 | 43.6 | 2.52 | 4.17 | 19.90 | |||

| Fresh | 7.155 | 45.9 | 1.97 | 1.70 | 8.73 |

TVIRD currently does not plan to conduct any work to verify the historical estimates other than using them to guide its exploration, resource modeling and possible development work. At the appropriate time, TVIRD plans to assess the mine development and production plan as included in the Feasibility Study in order to develop its own plan for further exploration and possible development. TVIRD is evaluating steps that would be required to upgrade or verify the foregoing historical estimates as current under NI 43-101 standards, which would include a review of past drill results and Quality Assurance/Quality Control procedures applied as well as possibly resource modeling with the involvement of a qualified person.