| At A Glance | |

| Ownership: | Mt. Labo Exploration and Development Corporation (100%), of which TVI Resource Development Phils., Inc. holds a 60% interest through its 100% ownership of SageCapital Partners, Inc. |

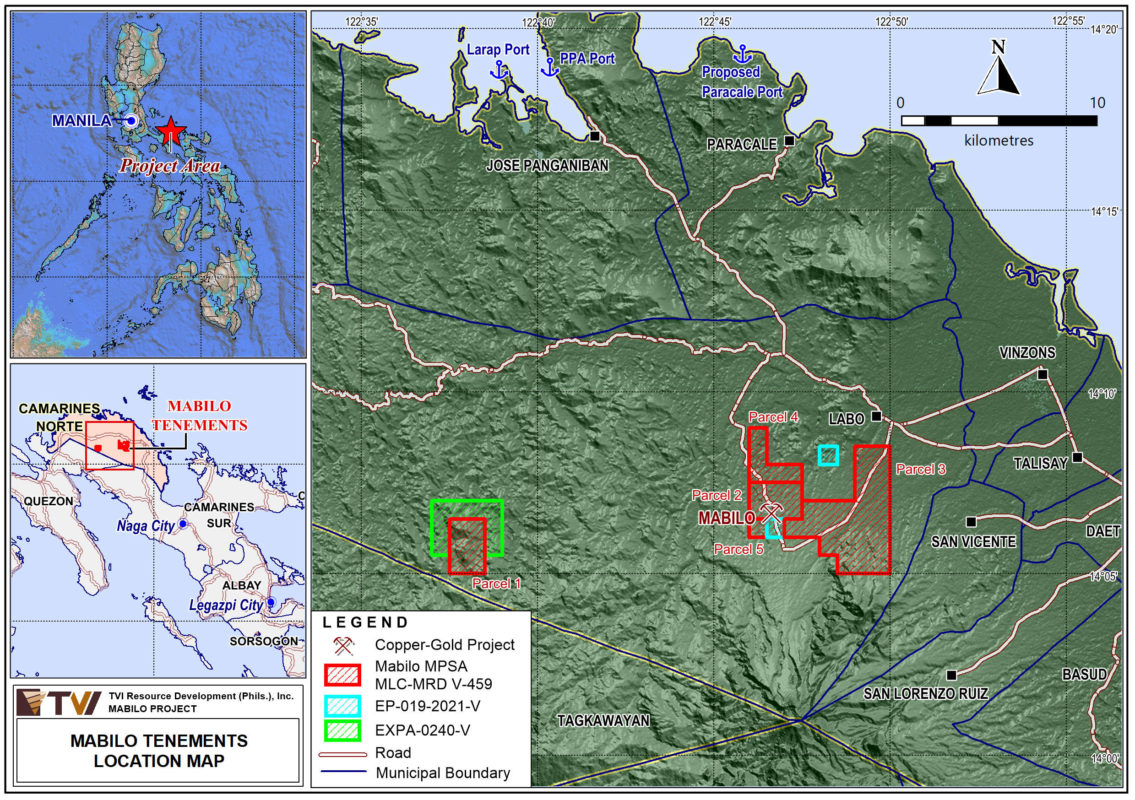

| Location | Camarines Norte Province, Eastern Luzon, Philippines |

| Business activities | Brownfield project that hosts a copper-gold-magnetite skarn deposit offering potential for multi-metal products, namely copper, gold, and silver, with by-products magnetite (Fe3O4) and pyrite (FeS2). |

| Deposit Type | Copper-gold-magnetite skarn deposit |

| Resource | Combined Indicated and Inferred 12.8M tonnes at 1.8% Cu, 1.9 g/t Au, 9.6 g/t Ag and 40.5% Fe |

| Probable Reserve | 7.8Mt at 2.0% Cu, 2.0g/t Au, 8.8g/t Ag and 45.5% Fe |

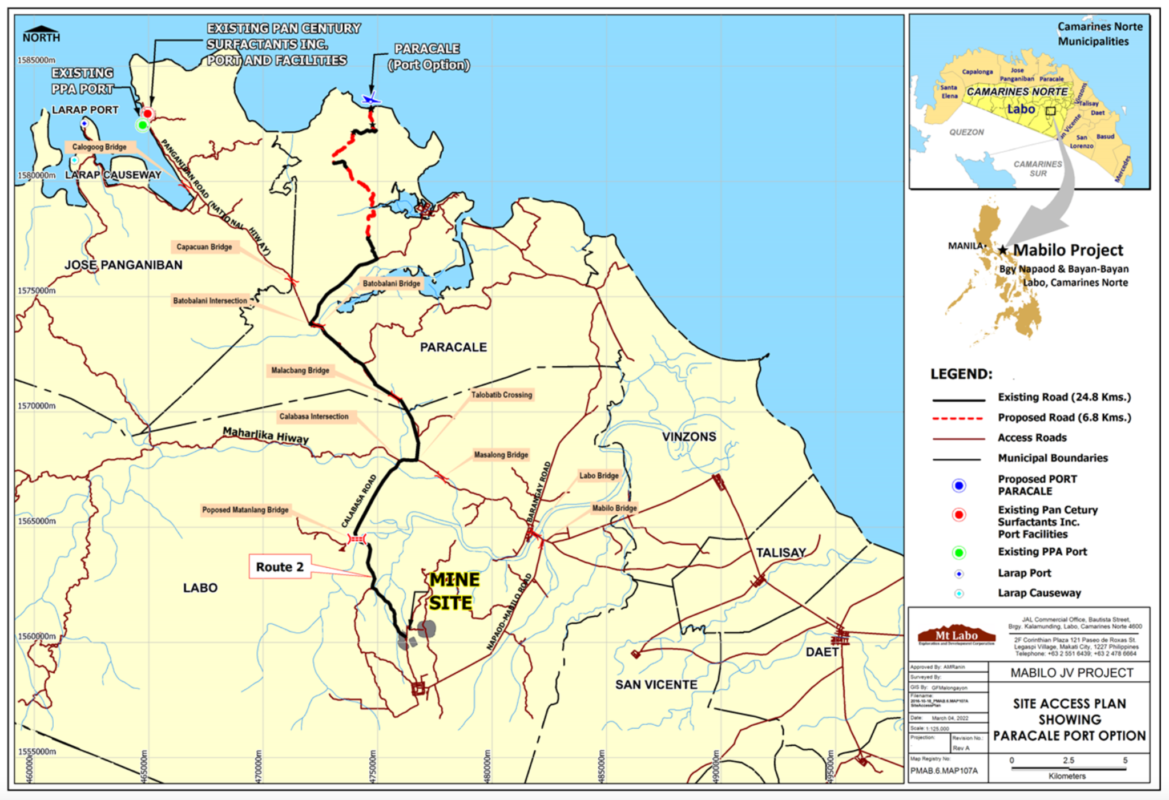

| Logistics | Accessed from the nearby town of Labo, using a 12 km concrete road. |

TVIRD acquired all of the outstanding capital stock of SageCapital Partners, Inc. (“SageCapital”) in Q1 2022, pursuant to a Sale and Purchase Agreement (the “SageCapital Agreement”) between TVIRD and a third-party resident of the Philippines (“Vendor”). SageCapital is a holding company incorporated under the laws of the Philippines and, in turn, owns 60% of the outstanding capital stock of Mt. Labo Exploration and Development Corporation (“MLEDC”), a Philippine mining and minerals exploration development company that operates the Mabilo Project (“Mabilo”), located in the Camarines Norte Province, Eastern Luzon, Philippines.

In May 2016, MLEDC completed a feasibility study on Mabilo (the “Feasibility Study”), supported by a technical report titled “Mabilo Project National Instrument 43-101 Technical Report,” prepared by Lycopodium Minerals Pty Ltd. This report, dated and filed on May 2, 2016, has a mineral reserve and mineral resource effective date of November 2015. RTG Mining Inc. (“RTG”), which holds a 40% interest in MLEDC through SRM Gold, has filed the technical report under RTG’s SEDAR profile (the “Mabilo Technical Report”). The Mabilo Technical Report includes a historical Probable Mineral Reserves estimate of 7.8 Mt at 2.0% Cu, 2.0 g/t Au, 8.8 g/t Ag, and 45.5% Fe. The metal price assumptions applied in the report were US$5,200/tonne for Cu, US$1,125/oz for Au, US$15/oz for Ag, and US$65/tonne for magnetite. TVI considers this report no longer current and cautions that it should not be relied upon.

Mabilo is covered by an approved Declaration of Mining Project Feasibility (“DMPF”) and Environmental Compliance Certificate (“ECC”) for initial direct shipping ore (“DSO”) operations, issued by the Mines and Geosciences Bureau (“MGB”) and the Environmental Management Bureau (“EMB”), respectively, of the Department of Environment and Natural Resources (“DENR”) of the Republic of the Philippines.

With an open-pit mining method contemplated at Mabilo, the lifting of the open-pit mining ban in the Philippines, as announced by the DENR on December 23, 2021, is a significant development.

The Mabilo Project is located in the Camarines Norte Province, Eastern Luzon, Philippines, which is one of the major traditional gold mining centers in the country. The area is easily accessed from the nearby town of Labo via a 12 km concrete road.

The project is covered by the following mining tenements: Mineral Production Sharing Agreement (“MPSA”) MLC-MRD V-459 Amended (Renewal), covering 3,848.2 hectares; Exploration Permit EP-019-202-V, covering 165.9 hectares; and Exploration Permit Application EXPA-0240-V (formerly APSA-002-V), covering 648 hectares. Together, these tenements cover a total area of 4,298.1 hectares.

With a near-surface deposit, Mabilo has the potential for direct shipping ore (DSO) operations, and it is contemplated that mining will use an open-pit method. The Mabilo mineralized deposit is classified as a copper-gold-magnetite skarn deposit, offering the potential for multi-metal products, namely copper, gold, and silver, with by-products including magnetite (Fe₃O₄) and pyrite (FeS₂).

MLEDC undertook its first drilling program in 2012, designed to target the seven magnetic anomalies identified by a ground magnetic survey. The second drilling program, conducted from 2013 to 2015, included 112 drill holes with a total meterage of 19,542 meters. In March 2018, the MGB validated the Final Exploration Report submitted in June 2015 as part of the application for a Declaration of Mining Project Feasibility (DMPF). Subsequently, the Environmental Compliance Certificate (ECC) and DMPF for initial DSO operations were approved in 2020.

The Mineral Resource estimate, prepared by the independent consultancy CSA Global Pty Ltd (“CSA Global”) and announced by RTG on November 6, 2015, is based on data obtained from 99 diamond drill holes totaling 18,201 meters, completed by the end of September 2015. The estimate used a cut-off grade of 0.3 g/t Au or 0.3% Cu. Drilling was conducted on a nominal 40-meter by 40-meter pattern along strike, with infill drilling in some areas on a 20-meter by 20-meter pattern. This Mineral Resource estimate is filed under RTG’s SEDAR profile.

On November 5, 2015, RTG announced that an independent resource consultancy, CSA Global, had prepared a Mineral Resource estimate, which was subsequently incorporated into the Feasibility Study. The Mineral Resource estimate is filed under RTG’s SEDAR profile.

The mineral resource estimate is based on data obtained from 99 diamond drill holes totaling 18,201 meters, completed by the end of September 2015. It uses a cut-off grade of 0.3 g/t Au or 0.3% Cu. Drilling was conducted on a nominal 40-meter by 40-meter pattern along strike, with some areas infilled to a 20-meter by 20-meter pattern.

| Classification | Million Tonnes | Cu % | Au g/t | Ag g/t | Fe % | Cu Metal (Kt) | Au Oz ('000s) | Fe Metal (Kt) |

| Indicated | 8.9 | 1.9 | 2.0 | 9.8 | 45.6 | 169.3 | 577.6 | 4,034.5 |

| Inferred | 3.9 | 1.5 | 1.5 | 9.1 | 29.0 | 58.0 | 184.9 | 1,134.1 |

| Total | 12.8 | 1.8 | 1.9 | 9.6 | 40.5 | 227.3 | 762.5 | 5,168.6 |

On May 2, 2016, RTG filed the Mabilo Technical Report, prepared by Lycopodium Minerals Pty Ltd., on its SEDAR profile. The report is based on the results of a Feasibility Study completed for the Mabilo Project and includes the following details:

Table 2. Mabilo Probable Mineral Reserve as filed by RTG on May 2, 2016

| PROBABLE | MINERAL | RESERVE | ESTIMATE | |||||

| Ore | Waste | |||||||

| Class | Type | Mt | Fe% | Au g/t | Cu % | Ag g/t | Mt | Strip Ratio |

| Gold cap | 0.351 | 40.1 | 3.11 | 0.38 | 3.26 | |||

| Probable | Supergene | 0.104 | 36.5 | 2.20 | 20.70 | 11.90 | 77.13 | 10.0 |

| Oxide scarn | 0.182 | 43.6 | 2.52 | 4.17 | 19.90 | |||

| Fresh | 7.155 | 45.9 | 1.97 | 1.70 | 8.73 |

TVIRD currently does not plan to undertake any additional work to verify the historical estimates beyond using them to guide its exploration, resource modeling, and possible development work. At an appropriate time, TVIRD intends to review the mine development and production plan outlined in the Feasibility Study to develop its own plan for further exploration and possible development. Additionally, TVIRD is evaluating the necessary steps to upgrade or verify these historical estimates in accordance with NI 43-101 standards. This process would include reviewing of past drill results and Quality Assurance/Quality Control procedures, and engaging a Qualified Person for resource.

yt2l1b

2syzvk

مرحبًا، أعتقد أن هذه مدونة ممتازة. لقد عثرت عليها بالصدفة ;

meget af det dukker op overalt på internettet uden min aftale.

webside er virkelig bemærkelsesværdig for folks oplevelse, godt,

Muito obrigado!}

Obrigado|Olá a todos, os conteúdos existentes nesta

at web, except I know I am getting familiarity all the time by reading thes pleasant posts.|Fantastic post. I will also be handling some of these problems.|Hello, I think this is a great blog. I happened onto it;) I have bookmarked it and will check it out again. The best way to change is via wealth and independence. May you prosper and never stop mentoring others.|I was overjoyed to find this website. I must express my gratitude for your time because this was an amazing read! I thoroughly enjoyed reading it, and I’ve bookmarked your blog so I can check out fresh content in the future.|Hi there! If I shared your blog with my Facebook group, would that be okay? I believe there are a lot of people who would truly value your article.|منشور رائع. سأتعامل مع بعض هذه|

enten oprettet mig selv eller outsourcet, men det ser ud til

værdsætter dit indhold. Lad mig venligst vide det.

|Tato stránka má rozhodně všechny informace, které jsem o tomto tématu chtěl a nevěděl jsem, koho se zeptat.|Dobrý den! Tohle je můj 1. komentář tady, takže jsem chtěl jen dát rychlý

الاستمرار في توجيه الآخرين.|Ahoj, věřím, že je to vynikající blog. Narazil jsem na něj;

værdsætter dit indhold. Lad mig venligst vide det.

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

har også bogmærket dig for at se på nye ting på din blog Hej! Har du noget imod, hvis jeg deler din blog med min facebook

reading this weblog’s post to be updated daily.

Tak skal du have!|Olá, creio que este é um excelente blogue. Tropecei nele;

reading this weblog’s post to be updated daily.

pokračovat v tom, abyste vedli ostatní.|Byl jsem velmi šťastný, že jsem objevil tuto webovou stránku. Musím vám poděkovat za váš čas

fortsæt med at guide andre. Jeg var meget glad for at afdække dette websted. Jeg er nødt til at takke dig for din tid

webside er virkelig bemærkelsesværdig for folks oplevelse, godt,

fortsæt det gode arbejde stipendiater. Med at have så meget indhold og artikler gør du det

Esta página tem definitivamente toda a informação que eu queria sobre este assunto e não sabia a quem perguntar. Este é o meu primeiro comentário aqui, então eu só queria dar um rápido

webside er virkelig bemærkelsesværdig for folks oplevelse, godt,

Very nice post. I just stumbled upon your weblog and wished to say that I have really enjoyed surfing around your blog posts. In any case I’ll be subscribing to your rss feed and I hope you write again very soon!

také jsem si vás poznamenal, abych se podíval na nové věci na vašem blogu.|Hej! Vadilo by vám, kdybych sdílel váš blog s mým facebookem.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is fundamental and all. However think about if you added some great pictures or video clips to give your posts more, “pop”! Your content is excellent but with pics and video clips, this blog could definitely be one of the very best in its niche. Fantastic blog!

Thanks for ones marvelous posting! I really enjoyed reading it, you’re a great author.I will remember to bookmark your blog and may come back later on. I want to encourage you continue your great posts, have a nice holiday weekend!

gruppe? Der er mange mennesker, som jeg tror virkelig ville

Hey There. I found your blog using msn. This is a really well written article. I will make sure to bookmark it and return to read more of your useful information. Thanks for the post. I’ll certainly comeback.

devido a esta maravilhosa leitura!!! O que é que eu acho?

ocenili váš obsah. Dejte mi prosím vědět.

Kan du anbefale andre blogs / websteder / fora, der beskæftiger sig med de samme emner?

enten oprettet mig selv eller outsourcet, men det ser ud til

|Tato stránka má rozhodně všechny informace, které jsem o tomto tématu chtěl a nevěděl jsem, koho se zeptat.|Dobrý den! Tohle je můj 1. komentář tady, takže jsem chtěl jen dát rychlý

reading this weblog’s post to be updated daily.

Fiquei muito feliz em descobrir este site. Preciso de agradecer pelo vosso tempo

Znáte nějaké metody, které by pomohly omezit krádeže obsahu? Rozhodně bych ocenil

enten oprettet mig selv eller outsourcet, men det ser ud til

الاستمرار في توجيه الآخرين.|Ahoj, věřím, že je to vynikající blog. Narazil jsem na něj;

enten oprettet mig selv eller outsourcet, men det ser ud til

for the reason that here every material is quality based

Tak skal du have!|Olá, creio que este é um excelente blogue. Tropecei nele;

It contains fastidious material.|I think the admin of this website is actually working hard in favor of his site,

Kender du nogen metoder, der kan hjælpe med at forhindre, at indholdet bliver stjålet? Det ville jeg sætte stor pris på.

مرحبًا، أعتقد أن هذه مدونة ممتازة. لقد عثرت عليها بالصدفة ;

reading this weblog’s post to be updated daily.

nogensinde løbe ind i problemer med plagorisme eller krænkelse af ophavsretten? Mit websted har en masse unikt indhold, jeg har

apreciariam o seu conteúdo. Por favor, me avise.

Podem recomendar outros blogues/sites/fóruns que tratem dos mesmos temas?

meget af det dukker op overalt på internettet uden min aftale.

reading this weblog’s post to be updated daily.

Fantastic blog you have here but I was curious about if you knew of any forums that cover the same topics discussed in this article? I’d really love to be a part of group where I can get comments from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Thanks!

Também tenho o seu livro marcado para ver coisas novas no seu blog.

) Vou voltar a visitá-lo uma vez que o marquei no livro. O dinheiro e a liberdade são a melhor forma de mudar, que sejas rico e continues a orientar os outros.

Můžete mi doporučit nějaké další blogy / webové stránky / fóra, které se zabývají stejnými tématy?

Obrigado|Olá a todos, os conteúdos existentes nesta

We are a group of volunteers and opening a new scheme in our community. Your site provided us with valuable info to work on. You have done an impressive job and our whole community will be grateful to you.

skupině? Je tu spousta lidí, o kterých si myslím, že by se opravdu

Nice post. I was checking continuously this blog and I’m impressed! Very useful info specifically the last part 🙂 I care for such info a lot. I was looking for this particular info for a very long time. Thank you and best of luck.

webside er virkelig bemærkelsesværdig for folks oplevelse, godt,

reading this weblog’s post to be updated daily.

Throughout this grand scheme of things you’ll receive a B+ just for effort and hard work. Where you lost me was first on the facts. You know, as the maxim goes, details make or break the argument.. And it couldn’t be more true here. Having said that, permit me tell you what exactly did work. The authoring is really engaging which is probably why I am making the effort to opine. I do not make it a regular habit of doing that. Second, although I can certainly see the leaps in logic you come up with, I am not really confident of exactly how you seem to unite your ideas which produce the conclusion. For right now I will subscribe to your point but trust in the foreseeable future you actually link the facts better.

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

https://tastyslips.com/et/products/517613/kasutatud-aluspueksid-paerast-armatsemist-naiste-aluspesu

I know this if off topic but I’m looking into starting my own blog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web savvy so I’m not 100 positive. Any tips or advice would be greatly appreciated. Appreciate it

for the reason that here every material is quality based

díky tomuto nádhernému čtení! Rozhodně se mi líbil každý kousek z toho a já

muito dele está a aparecer em toda a Internet sem o meu acordo.

Esta página tem definitivamente toda a informação que eu queria sobre este assunto e não sabia a quem perguntar. Este é o meu primeiro comentário aqui, então eu só queria dar um rápido

information.|My family members every time say that I am killing my time here

Podem recomendar outros blogues/sites/fóruns que tratem dos mesmos temas?

information.|My family members every time say that I am killing my time here

fortsæt det gode arbejde stipendiater. Med at have så meget indhold og artikler gør du det

har også bogmærket dig for at se på nye ting på din blog Hej! Har du noget imod, hvis jeg deler din blog med min facebook

fortsæt det gode arbejde stipendiater. Med at have så meget indhold og artikler gør du det

5e0c3p

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Pretty section of content. I just stumbled upon your website and in accession capital to assert that I get in fact enjoyed account your blog posts. Anyway I will be subscribing to your feeds and even I achievement you access consistently rapidly.

Perfect work you have done, this web site is really cool with great information.

selam

I like this web blog its a master peace ! Glad I found this on google .

pcfphl

Muito obrigado!}

great points altogether, you simply gained a new reader. What would you suggest in regards to your post that you made some days ago? Any positive?

Greetings! Very useful advice in this particular article! It is the little changes which will make the biggest changes. Thanks for sharing!

If you would like to get a great deal from this article then you have to

apply these methods to your won blog.

yjjbzw

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

الاستمرار في توجيه الآخرين.|Ahoj, věřím, že je to vynikající blog. Narazil jsem na něj;

Can I simply say what a relief to find somebody that truly understands what they’re discussing on the web. You actually understand how to bring an issue to light and make it important. More and more people must look at this and understand this side of the story. I can’t believe you aren’t more popular because you certainly possess the gift.

Greetings from Colorado! I’m bored to death at work so I decided to check out your blog on my iphone during lunch break.I really like the knowledge you present here and can’twait to take a look when I get home. I’m surprised athow quick your blog loaded on my mobile .. I’m noteven using WIFI, just 3G .. Anyways, fantastic site!

Conoce el camino de Marcelo desde las calles de Brasil hasta la gloria | Conoce como Marcelo combina habilidad y dedicacion en su juego | Conoce el legado de Marcelo y su influencia en el futbol brasileno | Informate sobre los primeros anos de Marcelo en el futbol | Explora como Marcelo ha inspirado a las nuevas generaciones | Descubre los valores y etica de Marcelo dentro y fuera del campo | Descubre como Marcelo ha marcado una era en el Real Madrid | Descubre la trayectoria completa de Marcelo en el mundo del futbol | Conoce la carrera de Marcelo desde sus inicios hasta la actualidad, Marcelo y sus exitos Exitos Marcelo</url].

As you’ll remember mutual funds spend money on a basket of securities like stocks, bonds, gold and worldwide securities.

Besley, Timothy J.; Persson, Torsten (2012).

Hey, I came across your blog, and I must say the information you’re providing is truly amazing! The insights and details you’ve shared are incredibly helpful, and your writing style makes it so easy to understand. Keep up the great work — I’m looking forward to reading more!

Good day! I simply want to give an enormous thumbs up for the great data you may have here on this post. I might be coming back to your weblog for more soon.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

公益社団法人日本水難救済会. “くま クマ 熊 ベアー 5”.主婦と生活社.演:沖わか子 小雪と同室の看護婦。虎之介の結婚後はたびたび後を追い回し、新婚夫婦をゲンナリさせる。虎之介に惚れていたが、最終的には新との結婚を祝福。 お互いの感情の行き違いから離婚寸前まで陥ったが周囲の取りなしもあり龍之介と復縁。演:河内桃子龍之介の妻。演:水野哲 龍之介と章子との一人息子。

1c5pf9

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

123456

Hi there mates, how is everything, and what you wouldlike to say concerning this post, in my view its in fact remarkable for me.

Wow, superb blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your site is excellent, as well as the content!

great publish, very informative. I’m wondering why the opposite specialists of this sector don’t notice this. You should proceed your writing. I’m confident, you have a great readers’ base already!

rüyada beyaz tilki görmek

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Many individuals who lift weights want to construct

muscle and burn fat at the identical time, but they typically hear that it’s

impossible. Such myths become a actuality with a trenbolone/Winstrol cycle, where a user’s waist measurement decreases and muscle

size increases simultaneously. Blood pressure will have to

be monitored very regularly on this cycle, as it’s

more likely to spike to very excessive levels. To counteract this and shield

the guts as a lot as potential, customers ought to carry out cardio.

In summary, there are various advantages that female anabolic steroid users

hold over male customers, and there are various advantages

that male customers maintain over feminine users.

There additionally exist disadvantages which may be totally different pertaining to each genders.

Extreme muscle and energy gains, combined with rapid fats

loss, may be anticipated with this cycle.

Steroid half-lives are the amount of time it might take half of the

steroid to get out of yoursystem. Mainly, half-lives must be considered in correct planning

for dosing and frequency.For instance, Testosterone Enanthate’s half-life is about

8-10 days, and Dianabol’s is 3-5hours. Testosterone can be an effective chopping

agent; however, fluid retention can accumulate

(unless an anti-estrogen is taken). This is as a end result of of a lower in nitric oxide, a molecule that promotes vasodilation and blood move to the penis.

Thus, Deca Durabolin users can experience impotence (erectile dysfunction), often identified as ‘Deca dick’ (5).

Taking exogenous HGH amplifies these mechanisms of action considerably.

Urine exams are accomplished to check for breakdown merchandise of anabolic steroids.

Any steroid stacked with Anadrol is going to provide better results than taking

it alone, along side exacerbated liver enzymes and levels of

cholesterol. Even when utilized in a medical environment

with expert supervision, we still observe toxicity and adverse effects.

Thus, Anadrol cannot be considered 100 percent safe when utilized in bodybuilding doses.

This transformation was from a bodybuilder who was beforehand

pure (left) after which took Anadrol (right).

As Soon As you’ve actually reached the stage of advanced data and advanced expertise with steroids, it is possible for you to

to maneuver to the best and most advanced degree of anabolic steroid use.

It can (and should) take years to get to the point where you could be thought of an advanced consumer, and this is a gradual

course of rather than one thing you abruptly achieve in a single day.

Your goal ought to be to acquire slow and regular advancement by way of your experiences with each steroid cycle.

If the four hundred mg every week is tolerated properly, the user

might even improve it to 600 milligrams every week. If we’re to

place it in the context of substance use, then it

can be stated that dose is the quantity of steroid administered to

reinforce one’s efficiency within the gym.

So, how will you get these wide-ranging results from any other product, avoiding

the HGH’s risks and aspect effects? Lastly, we can’t compare HGH and Anavar without discussing

the fee. HGH might be the most costly compound to buy, and the reality that you have to use it for months on end to get first rate results adds

to that cost. It can simply set you back many 1000’s of dollars to

a 4-6 month HGH cycle. They don’t provide you

with a direct type of HGH, as is the case whenever you

take HGH itself.

A cycle can vary wherever from a number of weeks up

to several months of utilization, followed by a period with either

no steroid use in any respect or utilizing

at a lower dosage. Your cycle length will depend on your experience with steroids, which steroid you’re taking, and what do steriods do; Flora, objectives you’re

making an attempt to attain. In our experience, bodybuilders have an increased danger of nephrotoxicity,

with a quantity of of our patients displaying excessive creatinine levels.

Leal Herlitz, MD, examined the kidney function of 10 bodybuilders who had utilized steroids long-term.

She diagnosed 90% of them with focal segmental glomerulosclerosis

(5). In terms of its benefits and opposed effects, we

find Winstrol to be slightly more potent than Anavar.

Thus, on Winstrol, we observe users constructing slightly extra muscle whereas

experiencing harsher side effects.

Unfavorable libido impacts are attainable; dosage is often set at

half of the testosterone dose to combat this. Corticosteroids are one other well-known group,

however corticosteroids have totally different medical uses29.

They’re great for decreasing inflammation and overactive

immune response, but they won’t serve you for muscle progress.

Steroids have a strong anti-catabolic effect on muscular tissues (after all, they are ANABOLIC steroids – the alternative of catabolic).

Stress hormones like cortisol, naturally rising during intense train, contribute to muscle breakdown and loss.

The cycle runs for 7 good weeks and encompasses 200 mg

per day of testosterone for the primary 2 weeks, 300 mg per day for the following three weeks and ending with 350 mg per day for the remaining 2 weeks.

For example, Deca Durabolin is usually taken in delicate

bulking cycles to add slightly more dimension while keeping harmful side effects at bay.

Dianabol may be stacked with trenbolone; nonetheless, it usually causes bloating and thus counteracts trenbolone’s diuretic properties (similar to Anadrol).

Despite the reality that Anavar is an oral steroid, the kidneys additionally course of it,

so it doesn’t put much pressure on the liver.

Thus, we consider the chance of serious liver injury through this cycle to be low.

The results from this cycle will be similar to these of Winstrol and trenbolone.

I blog quite often and I truly appreciate your information. The articlehas really peaked my interest. I am going to book mark your site and keep checking fornew details about once a week. I opted in for your RSS feed too.

Fifty two Week Hello/Low Chart: 52 week Hi/Low chart Indices indicates that a selected inventory is buying and selling at its lowest or highest from past fifty two weeks.

Thanks for sharing your info. I really appreciate your efforts and I willbe waiting for your next write ups thanks once again.

k9vb7d

70918248

References:

steroid medications – gbx9.com –

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Each lancet, as an alternative of having a large number of small figures in medallions, had a single main determine in each part, usually a saint or apostle, in colored glass, surrounded and set off by delicate patterns of white or frivolously-tinted glass.

har også bogmærket dig for at se på nye ting på din blog Hej! Har du noget imod, hvis jeg deler din blog med min facebook

好きだからこそ従ってしまうのは、相手を調子に乗らせる原因にもなりそうなことがわかりますよね。 この論争は、行政への協力を引き出したい岐阜県の思惑と、大垣共立銀行と十六銀行の”面子をかけた争い”の側面も否定できない。 ソビエト戦争で、レーニンが率いたボリシェビキ軍に敗退していた。、早期退職者の募集に手を挙げ碧の担当を漱石に引き継ぐ。 “震災遺構の旧門脇小、4月3日から公開 石巻市”.「来年度から遺構整備 門脇と大川の旧学校施設(石巻市)」『『日刊建設新聞』』2018年12月28日。 27May 2020. 2020年5月28日閲覧。