TVIRD’s Canadian affiliate reports strong showing in `09

Key Financial Achievements for the Years Ended December 31, 2009 and 2008

· Increase in net revenue to $67,103,108 (Php2,794,798,334) from $5,972,764 (Php248,865,167)

· Increase in operating cash flow to $21,661,992 (Php902,207,080) from a deficit of $13,506,114 (Php562,754,792)

· Increase in net income to $18,322,345 (Php763,113,078) from a net loss of $12,714,279 (Php529,761,625)

· 2009 production cash cost of $0.61 (Php29.31) per copper equivalent pound

CALGARY, ALBERTA – TVI Pacific Inc. (“TVI” or “the Company”), the Canadian affiliate of TVI Resource Development Philippines, Inc. (“TVIRD”) today released audited, consolidated financial and operational results for the year ended December 31, 2009. This press release should be read in conjunction with the audited consolidated financial statements and management’s discussion and analysis for the year ended December 31, 2009, filed with certain securities regulators in Canada on March 25, 2010, and also available on our web site (www.tvipacific.com) and SEDAR (www.sedar.com).

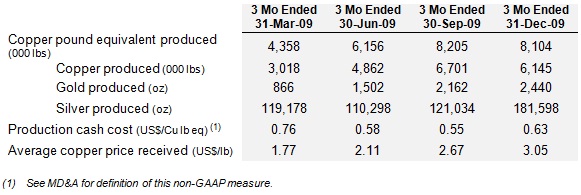

Key Operational Achievements Quarter Over Quarter

“As previously reported, a number of factors have contributed to our financial and operational success over the past year”, stated Cliff James, TVI’s President and CEO. “After the sulphide plant at the Canatuan mine reached commercial production on March 1, 2009, we were able to consistently ship concentrate almost every four weeks to generate cash flow. The steady state of operations, as well as process improvements at Canatuan and the improvement in copper prices during the year, has further strengthened our cash position. This has allowed us to fast-track development drilling at Balabag, pursue mine life expansion opportunities at Canatuan and advance plans to resume exploration activities at Tamarok. We also intend to continue exploration activities on our 1,240 km2 tenement package on the Zamboanga Peninsula that has the potential to host significant porphyry copper-gold, massive sulphide and epithermal gold deposits.”

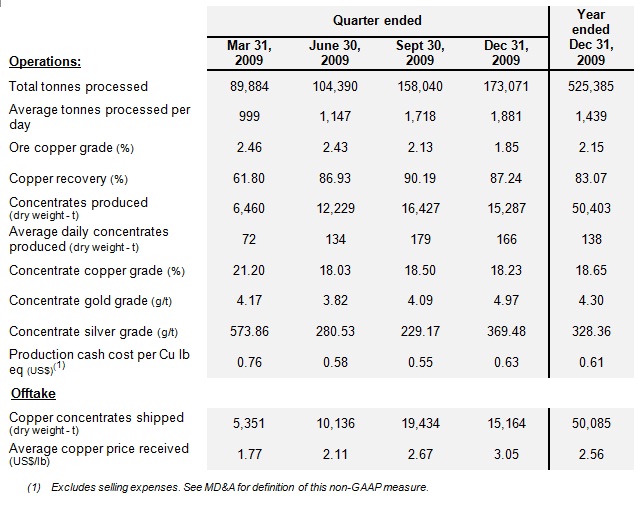

The following table details key operating statistics for the Canatuan Sulphide Mine for the year ended December 31, 2009.

2009 Highlights

· In January 2009, TVI finalized a US$30.1 million five-year term loan facility agreement. In only 12 months, two voluntary payments and two scheduled payments have been made, decreasing the original principal owing by 46% to US$16.2 million as of January 20, 2010.

· By March 2009, the company completed its first shipment of copper concentrates from the Canatuan mine. A total of 10 shipments of copper concentrates occurred in 2009 generating gross revenue of US$64 million. Subsequent to year end, an additional three shipments were completed for total gross revenues of US$26.2 million.

· In November 2009, construction commenced on an additional flotation circuit to process zinc ore at the Canatuan mine. The Zinc Circuit is expected to be fully operational by mid-Q2 2010 and is expected to monetize the zinc component of the deposit for an added revenue stream. Copper concentrate production will continue at a rate of approximately 5,000 tonnes per month while the zinc circuit is designed to produce approximately 1,000 tonnes of zinc concentrate per month.

· In December 2009, a Mineral Production Sharing Agreement ("MPSA") encompassing the Tamarok copper-gold project was formally approved by the Secretary of the Department of Energy and Natural Resources of the Philippines. This MPSA will allow advanced exploration activities including geophysical surveys, systematic detailed geological investigations and the delineation of drill targets.

· By December 31, TVI had recorded 2,048,506 work hours with no lost time incidents. This remarkable achievement is a reflection of a safe and supportive environment with professional management. TVI takes great pride in fostering a workplace that stresses safety, efficiency, responsibility and career development.

2010 Outlook

Canatuan Mine

The mine continues to achieve consistent operating throughput and concentrate production. It is anticipated that future shipments of approximately 5,000 dry metric tonnes each will occur approximately every six weeks. Previously, shipments occurred every four to six weeks. In order to significantly reduce shipping and freight costs, the Company will be increasing the grade of the copper content for each metric tonne of concentrate shipped. Therefore, with a fewer number of shipments in 2010, the Company intends to sell the same amount of metal content at a higher grade.

In March 2010, the Company received an amendment to its Environmental Compliance Certificate which increases the daily maximum allowable production rate to 2,500 tonnes per day and a maximum annual extraction rate of 2,500,000 tonnes per year. This allows the Company the capacity to process additional ore from other sources, including the Canatuan Near-Mine Tenements.

Balabag

As of February 22, 2010, drilling has commenced at the Balabag project on a 26 hole, 2,500 metre drilling program focused on the Tinago vein, the largest of three spatially related vein systems occurring at Balabag Hill. This program aims to define the area where the Tinago vein system is anticipated to extend to depth. The target is a minimum of 50,000 gold equivalent ounces in the indicated category, allowing for a scoping study to define an economical start-up mine development program.

The Balabag gold project is a high priority for TVI. Based on preliminary exploration results, TVI believes that the Balabag property has the potential to become a second production centre for the Company.

Canatuan Near-Mine Tenements

A key factor in TVI’s forward strategy is to optimize profits from the producing Canatuan copper mine. This operation is the foundation or platform for growth for TVI. Exploration to date has identified several mineral occurrences on the surrounding tenements, including Tabingan, Matigdao and Palalian that TVI believes are compelling exploration prospects.

In February 2010, a Joint Venture agreement was finalized with DMCI-CERI (“DMCI”), a subsidiary of DACON Corporation, to conduct exploration, development and production of mineral deposits in the Greater Canatuan Tenement area. The JV partners will fund an exploration program in the Greater Canatuan Tenement area for a period of two years amounting to a maximum of US$2 million, to be shared in accordance with their respective interests.

The strategic alliance with DMCI allows for the opportunity to participate in a number of mineral properties around the Philippines. These properties are currently owned by DMCI and combining the talents of both companies may prove mutually beneficial over the longer term.

Tamarok

In North Zamboanga, TVI’s tenement package covers almost all the targets identified by a prior exploration program, numbering at least 20 epithermal gold, massive sulphide and porphyry copper-gold prospects. TVI’s first priority, the Tamarok copper-gold project, is located 60 kilometres north-northeast of the Balabag project. Reconnaissance work carried out to date supports historical findings and has discovered new prospects. A great deal of the mineralization in these areas occurs on the surface and has been easily accessible to the Company’s exploration teams.

A scout drilling program will test subsurface continuity of outcropping porphyry copper-gold mineralization at Malachite Hill, where an initial exploration program of a 38 metre continuous channel sample produced an average of 0.71% copper and 0.35 grams per tonne gold.

Other Non-Core Opportunities

TVI is constantly evaluating non-core opportunities for addition revenue. These include possible joint ventures, equipment and facility optimization options, and cost saving initiatives that can be monetized.

“We are moving our projects forward, we are capitalizing on our Philippine advantage, we have a proven strategy for growth and we will continue to execute on these strengths”, continued Cliff James. “2009 was a significant year for TVI. Please also view our new, updated presentation on our web site at www.tvipacific.com”.

About TVI Pacific Inc. (TSX: TVI)

TVI Pacific Inc. is a publically traded, profitable, low cost copper producer focused on the production, development, exploration and acquisition of precious and base metal mining projects in the Philippines. The Company’s interest in the Canatuan Mine and its other Philippine assets are held through its affiliate, TVI Resource Development (Phils.), Inc.

|

Rhonda Bennetto |

Ian McColl |

| Connect With Us www.tvipacific.com Follow us on Twitterwww.twitter.com/tvipacific Be a Fan at www.facebook.com/tvipacific |

|

The Toronto Stock Exchange has neither approved nor disapproved of the information contained herein.

IMPORTANT INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

Certain information set out in this Press Release constitutes forward-looking information. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "intend", "could", "might", "should", "believe", “schedule” and similar expressions. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information received from or disseminated by third parties. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions and that information received from or disseminated by third parties is reliable, it can give no assurance that those expectations will prove to have been correct. Forward-looking statements are subject to certain risks and uncertainties (known and unknown) that could cause actual outcomes to differ materially from those anticipated or implied by such forward-looking statements. Accordingly, readers should not place undue reliance upon the forward-looking statements contained in this News Release and such forward-looking statements should not be interpreted or regarded as guarantees of future outcomes.

Examples of forward-looking information in this News Release:

· future operating information for the sulphide operation at Canatuan (including the anticipated processing of zinc concentrates in the future)

· the use of cash generated from the sulphide operation at Canatuan to support exploration and development of other TVI projects in the Philippines

· completion date for the zinc circuit at the Canatuan mine and its impact on revenue streams

· impact of planned cost reduction initiatives

· the nature and timing of exploration activities surrounding the Canatuan mine and the potential for mine life extension

· the nature and timing of exploration activities for Balabag, Tamarok, Tapisa, EXPA 61, Bonbon and the Company’s other tenements in the Philippines

· the nature and timing of future development activities at Balabag

· potential future production and cash flows generated by Balabag

· the Company’s ability to raise capital and to continually add to mineral reserves through acquisitions, exploration and development

· timing for future shipments of copper concentrates

· estimates regarding the Company’s capital requirements

Material Risks:

· volatility of prices for precious metals and base metals

· commodity supply and demand

· fluctuations in currency and interest rates

· inherent risks associated with the exploration and development of mining properties

· ultimate recoverability of mineral reserves

· timing, results and costs of exploration and development activities

· availability of financial resources or third-party financing

· new laws (domestic or foreign)

· changes in administrative practices

· changes in exploration plans or budgets

· availability of equipment and personnel

Material assumptions:

· current mining and processing activities at Canatuan

· current throughput of the sulphide plant and anticipated expansions in the throughput

· prior experiences of management with mining and processing at Canatuan

· the estimated copper and zinc mineralization of the sulphide zone at Canatuan

· the current development and operating plan for Canatuan

· anticipated production and sales of copper concentrates at Canatuan

· funds received from previously completed shipments of copper concentrates

· the Company’s evaluation of the content of the concentrate shipments and initial estimates received from MRI regarding the content of the concentrate shipments

· discussions held to date with MRI

· discussions held to date with DMCI

· experience gained during the first eleven concentrate shipments with MRI

· management’s experience during the construction of the gossan and sulphide plants at the Canatuan mine site

· anticipated throughput capacity of the zinc circuit,

· management’s cost targets and the reductions implemented to date

· the results of prior and current exploration activities

· timing of regulatory approvals from government authorities in the Philippines

· the Company’s experience in the Philippines

· previous financing endeavours and due diligence completed to date

· the Company’s overall budget and strategy, which plans, budget and strategy are all subject to change

The forward-looking statements of the Company contained in this news release are expressly qualified, in their entirety, by this cautionary statement.

Subject to applicable securities laws, the Company does not undertake any obligation to publicly revise the forward-looking statements included in this news release to reflect subsequent events or circumstances, except as required by law.